boulder co sales tax return form

Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

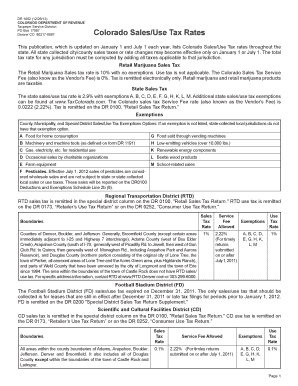

DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet.

. Sales tax returns may be filed quarterly. Colorado Sales Tax Guide Sales tax classes and videos available online at. 2020 BOULDER COUNTY SALES USE TAX The 2020 Boulder County sales and use tax rate is 0985.

If you have more than one business location you must file a separate return in Revenue Online for each location. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100. Longmont 515 Coffman Street Suite 114 Monday ONLY Hours.

CLAIM FOR REFUND OF BOULDER TAX. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. Sales tax returns are due the 20th of the month following the month reported.

Sales 000 of line 4 000 000 5C. Access and find resources about the Boulder Online Tax System below including how-to videos and PDF guides. Prepare and file your sales tax with ease with a solution built just for you.

For additionalon informatiregarding use taxefero tthe r Boulder Revised Code 3-2-1b. Sales tax returns may be filed annually. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

File Sales Tax Online. Ad Have you expanded beyond marketplace selling. Navigating the Boulder Online Tax System.

Accounting records must be retained by the collecting entity for three years from the date of filing and paying a return. Annual returns are due January 20. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Boulder CO.

DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. There are a few ways to e-file sales tax returns. Purpose of Form The Initial Use Tax Return is required to be filed by any.

Avalara can help your business. Amount of city FOOD SERVICE TAX 015 of line 5B 6. Boulder 1325 Pearl Street 2nd floor Boulder CO 80302 Monday thru Thursday Hours.

15 or less per month. Subcontractor Affidavit Page 2 1777 BROADWAY PO. Under 300 per month.

DR 0235 - Request for Vending Machine Decals. The minimum combined 2022 sales tax rate for Boulder Colorado is. 730 am5 pm Map Directions.

CR 0100AP - Business Application for Sales Tax Account. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Boulder CO. Boulder Online Tax System.

FID Taxable sales times 01 0001. Information about City of Boulder Sales and Use Tax. Excess Tax Collected 000 7.

Lafayette 1376 Miners Drive Unit 105 Tuesday ONLY Hours. 730 am5 pm Map Directions. Mailing Address PO Box 471 Boulder CO 80306-0471 New as of Jan 4 2021.

If you need additional assistance please call 303-441-3050 or e-mail us at. File Sales Tax Online Department of Revenue - Taxation. To manage your Colorado sales tax account file returns and pay state-collected sales taxes online.

Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. Filing frequency is determined by the amount of sales tax collected monthly. City of Boulder Sales Tax Form.

Boulder Online Tax System. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. 730 am5 pm Map Directions.

BOX 791 BOULDER CO 80306 303441- 3288. All payments of Boulder County sales tax should be reported through CDORs Revenue Online or through CDORs printable forms found at CDORs website. Boulder 386 - 290 110 0985 8845.

Typically returns must be filed on a monthly basis. Fishl1 Created Date. Such credit may not exceed the Boulder use tax due.

Assessor Boulder Longmont Drop Boxes. The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. PO Box 471 Boulder CO 80306.

Colorado Retail Sales Tax Return DR 0100 100719 COLORADO DEPARTMENT OF REVENUE Denver CO 80261-0013 ColoradogovTax DONOTSEND General Information Retailers must file a sales tax return for every filing period even if the retailer made no sales during the period and no tax is due. The 2022 sales tax rates for taxing districts in Boulder County are as follows. City Sales Tax _____ Date return was filedtax paid _____ Reporting period _____ to _____ Type of Tax _____ Reason for Refund IWe declare under the penalties of perjury that this claim including any accompanying schedules and statements has been.

DR 0154 - Sales Tax Return for Occasional Sales. Credit may be taken against Boulder use tax for legally imposed sales or use taxes paid to other municipalities. Refer to Boulder Revised Code BRC 1981 section 3-2-2 a 9- 14 and Tax Regulations.

Yes any person that owns construction equipment with a purchase price of 2500 or more and brings it into the City of Boulder for use or storage is required to file a Construction Equipment Declaration to determine the use tax that may be owed to the City.

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

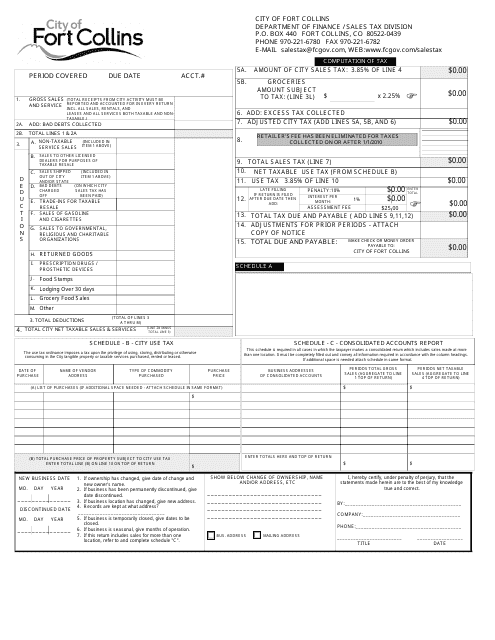

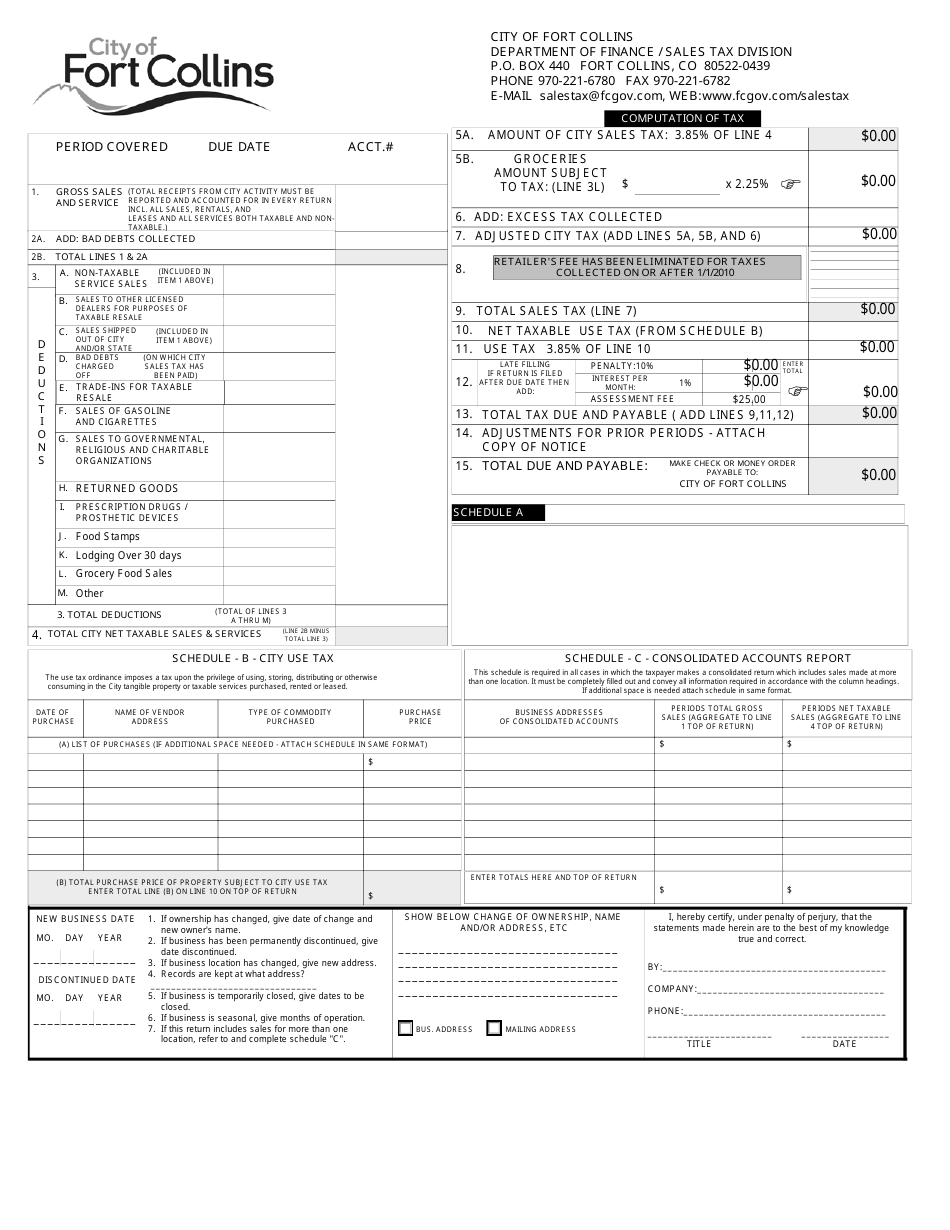

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Colorado Sales Tax Form Fill Online Printable Fillable Blank Pdffiller

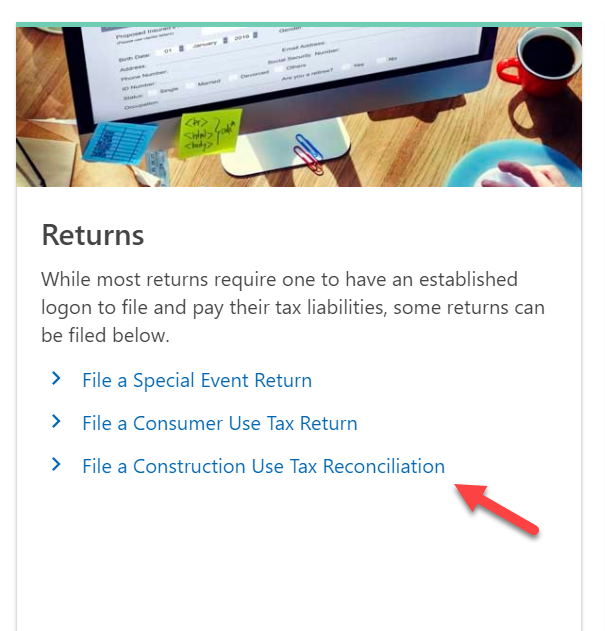

Construction Use Tax City Of Boulder

Denver Sales Tax Online Fill Online Printable Fillable Blank Pdffiller

Tenant Receipt Of Key S Ez Landlord Forms Lettering Being A Landlord Reference Letter

Sales And Use Tax City Of Boulder

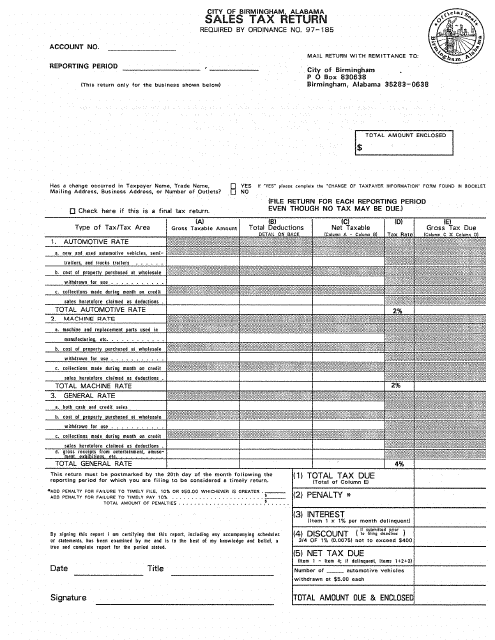

City Of Birmingham Alabama Sales Tax Return Form Download Printable Pdf Templateroller

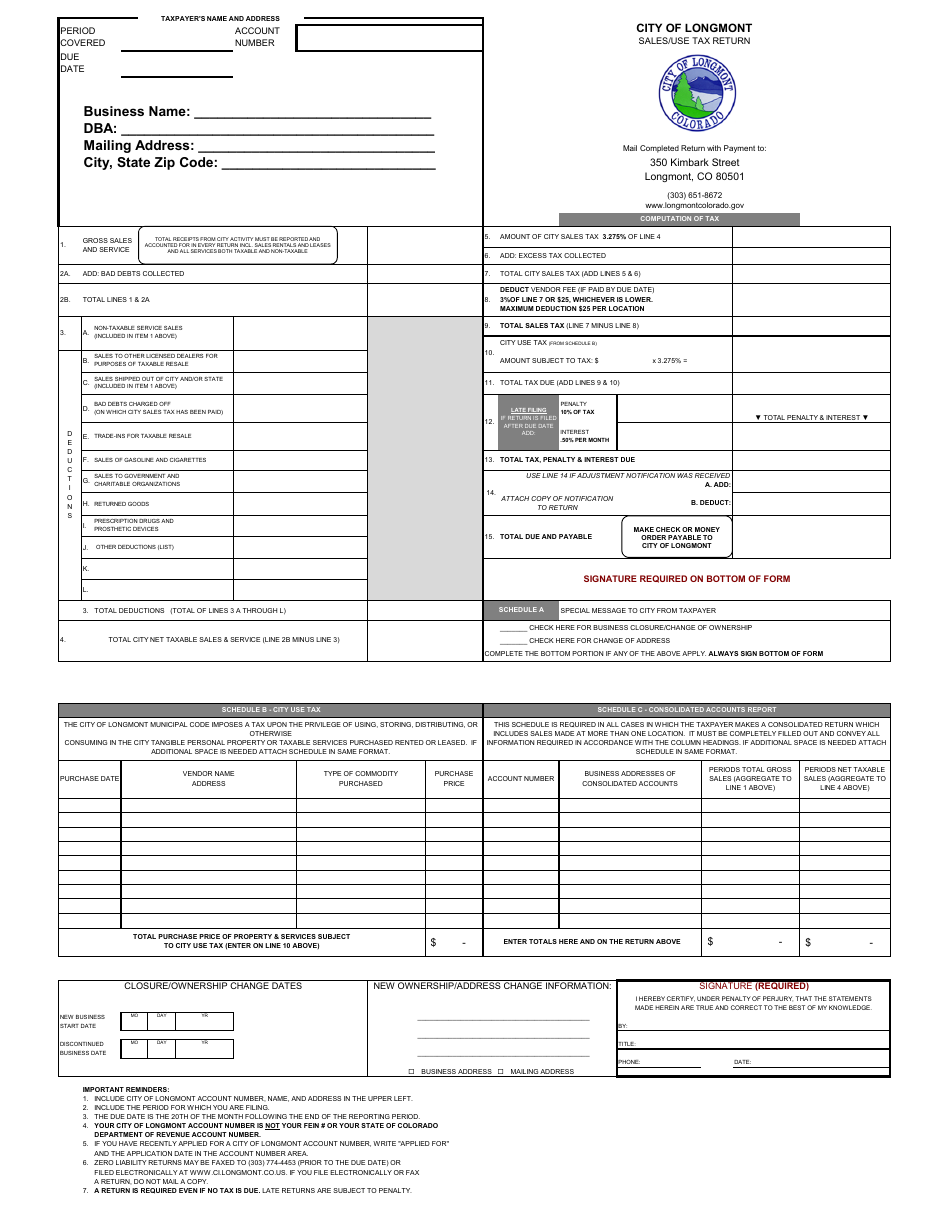

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Fillable Form 1040 Individual Income Tax Return Income Tax Return Tax Return Income Tax

City Of Fort Collins Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Online Sales And Use Tax Return Filing And Payment City Of Longmont Colorado